Table Of Content

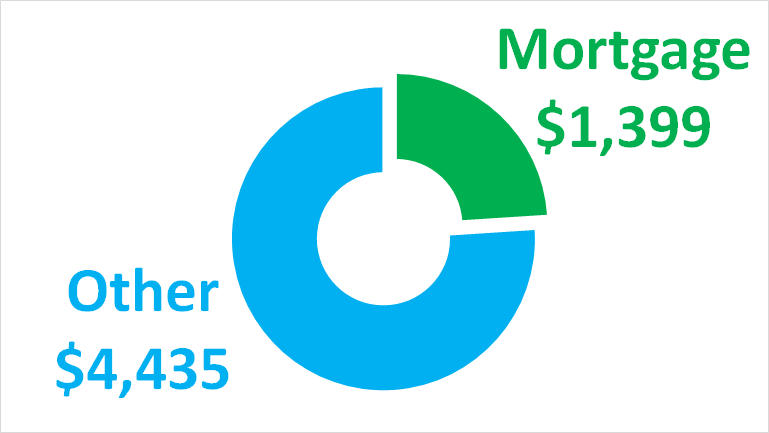

This means Los Angeles residents need an annual income of $249,471 to comfortably afford a median home, but only make $87,743 – a staggering $161,728 less than needed. Get started by contacting your insurance company or learning more about homeowners insurance. This video shows you how your mortgage payment should fit comfortably into your lifestyle. You might not want to borrow the maximum amount a lender offers you. Lenders don’t have a complete picture of your financial situation, despite all the paperwork they ask for.

How much are closing costs?

Here’s how much you need to make to afford a home in America - CNN

Here’s how much you need to make to afford a home in America.

Posted: Mon, 13 Nov 2023 08:00:00 GMT [source]

As a general trend, more rural U.S. states have lower costs compared with states home to numerous large cities, such as California and New York — especially when it comes to housing. To live comfortably in Massachusetts, a family of two working adults and two kids would need to earn $301,184 annually. Overall, prices in this category are 15.2 percent above the national average, and the best way to evaluate what you can and can’t do is to look at the individual price of your favorite activities. If this works for you, you can save a lot on transportation costs, not to mention the time you’d have to sit in traffic otherwise. When it comes to groceries, expenses are 13.7 percent above the national average.

Los Angeles utility prices

You can get private mortgage insurance if you have a conventional loan, not an FHA or USDA loan. Rates for PMI vary but are generally cheaper than FHA rates for borrowers with good credit. Statewide, the findings found that California is also the least affordable state for the average home buyer.

Tips For Buying An Affordable Home

If you cannot immediately afford the house you want, below are some steps that can be taken to increase house affordability, albeit with time and due diligence. In general, home-buyers should use lower percentages for more conservative estimates and higher percentages for more risky estimates. A 20% DTI is easier to pay off during stressful financial periods compared to, say, a 45% DTI. Home-buyers who are unsure of which option to use can try the Conventional Loan option, which uses the 28/36 Rule. This ratio is known as the debt-to-income ratio and is used for all the calculations of this calculator. Our simplified and secure online mortgage application will walk you through the process step by step.

Before you take on the maximum loan you can get and start looking at more expensive houses, consider these tips. Suppose you bought the same $200,000 house as above with the 15-year fixed mortgage at 5% but the mortgage interest rate changed to 6.25%. Your other two options, pay off debt and increase income, take time.

However, newcomers should be aware that traffic congestion is a significant issue, and public transportation options, while improving, may not cover all areas extensively. Besides entertainment, it has a diverse economy with strong sectors in technology, fashion, aerospace, and international trade. The Port of Los Angeles is one of the busiest ports in the world, playing a crucial role in global trade. The city also has a vibrant startup scene, with many tech companies choosing Los Angeles as their home.

How much mortgage payment can I afford?

In the mortgage process, it’s important to look at your budget, savings and assets for a couple of reasons. Mortgage term refers to the length of time you have to pay back the amount you’ve borrowed. The most common loan terms are 15 and 30 years, but other terms are available. Apply online for expert recommendations with real interest rates and payments. This means your money is going toward your actual debt and not interest on that debt. It’s important to remember that if you don’t manage to pay down the debt before the 0% APR offer ends, you might end up with a higher interest rate on your debt than you had before.

Want to buy a house? Here’s how much you must earn to afford a home in Florida - WFLA

Want to buy a house? Here’s how much you must earn to afford a home in Florida.

Posted: Tue, 17 Oct 2023 07:00:00 GMT [source]

You’ll stop paying PMI when your mortgage reaches about 78% of the home’s value. If the information being reported is accurate, make sure to resolve any collections accounts, pay your outstanding debt on time every month and, if possible, reduce your overall credit card debt. Keep in mind, however, that there are parameters for income eligibility (borrowers must earn a maximum of 115% of the median household income) and for the price and size of the house itself. Even if you can afford a certain amount of money, the eligibility might be for a less expensive home. Purchasing a home is a decision that will impact your finances for years to come. To avoid winding up with a home loan you can’t afford, calculate your monthly income and expenses carefully before you take the plunge.

How much do I need to earn to live in Los Angeles?

Just because a lender offers you a preapproval for a large amount of money, that doesn’t mean you should spend that much for your home. A mortgage loan term is the maximum length of time you have to repay the loan. Longer terms usually have higher rates but lower monthly payments. It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan balance. Homeowner's insurance is based on the home price, and is expressed as an annual premium. The calculator divides that total by 12 months to adjust your monthly mortgage payment.

You can also check out current mortgage rates in your area for an idea of what the market looks like. Even though Martin can technically afford House #2 and Teresa can technically afford House #3, both of them may decide not to. If Martin waits another year to buy, he can use some of his high income to save for a larger down payment.

Teresa may want to find a slightly cheaper home so she’s not right at that maximum of paying 36% of her pre-tax income toward debt. At a minimum, it’s a good idea to be able to make three months’ worth of housing payments out of your reserve, but something like six months would be even better. That way, if you experience a loss of income and need to find a new job, or if you decide to sell your house, you have plenty of time to do so without missing any payments. Bankrate.com is an independent, advertising-supported publisher and comparison service.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

The down payment is an essential component of home affordability. Bankrate’s mortgage calculator can help you explore how different purchase prices, interest rates and minimum down payment amounts impact your monthly payments. And don’t forget to think about the potential for mortgage insurance premiums to impact your budget.

Your credit score is another important factor in determining how much house you can afford. USDA loans require no down payment, and there is no limit on the purchase price. However, these loans are geared toward buyers who fit the low- or moderate-income classification, and the home you buy must be within a USDA-approved rural area. Depending on your credit score, you may be qualified at a higher ratio, but generally, housing expenses shouldn’t exceed 28% of your monthly income.

Most home loans require a 20% down payment, but Federal Housing Administration (FHA) loans only require a minimum of 3.5%. This type of loan opens the door for many potential homeowners that do not have the savings for a substantial down payment. However, this loan typically requires private mortgage insurance (PMI) which should be added into your monthly expenditures. PMI is usually .05-1% of the cost of the home loan but may vary depending on credit score. The Federal Housing Administration (FHA) is an agency of the U.S. government. An FHA loan is a mortgage loan that is issued by banks and other commercial lenders but guaranteed by the FHA against a borrower’s default.

And don’t forget you’d also need to pay a down payment and closing costs upfront, while keeping enough leftover to cover regular maintenance, upkeep and any emergency repairs that may arise. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios. If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI). You can still obtain a conventional loan with less than a 20% down payment, but PMI will be required.

No comments:

Post a Comment